.jpeg)

By Massie Whorley, The Commonwealth Institute

Starting October 1, over 620,000 low-to-moderate-income Virginians will have new options to find out how to access quality, affordable health insurance, according to a recent report from Families USA, a national nonprofit group that promotes expanded access to health care. And a whopping 88 percent of them come from families where at least one family member is employed.

The help will come from the new health insurance exchange – a marketplace for private insurance plans and consumers – being set up under the Affordable Care Act. Open enrollment is scheduled to begin in October for coverage that will start in January 2014. In addition to helping consumers find coverage, however, the exchange is also set up to help people pay for coverage. Tax credits are available to people with incomes between 100 percent and 400 percent of the federal poverty level (FPL) – about $19,530 and $78,120, respectively, for a family of three.

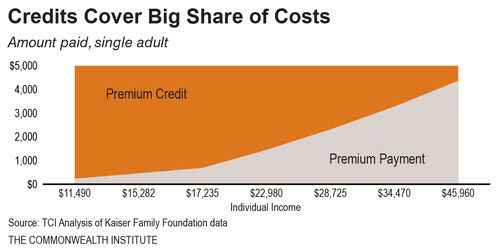

Just how much financial help will people get to pay for insurance through the exchange? The amount will vary based on income – the lower your income, the bigger your credit, and vice versa – and on the annual premium of the plan purchased. The tax credits are calculated so that individuals pay no more than a certain percentage of their income towards the cost.

Let’s use a hypothetical annual premium of $5,000 for a single adult to illustrate how the tax credits will work and the amount of help available.

Individuals who make $11,490 per year (100 percent of FPL) will generally be expected to pay no more than two percent of their income – about $230 per year for a health plan with an annual premium of $5,000. That works out to less than $20 per month for health insurance. That means their credit is worth $4,770. At the other end of the spectrum, individuals who make $45,960 per year (400 percent FPL), would receive a credit of $630 on the same plan. That leaves them paying $4,370 per year or $364 a month – 9.5 percent of their income.