By Mitchell Cole

For the original story posted by The Half Sheet, click here.

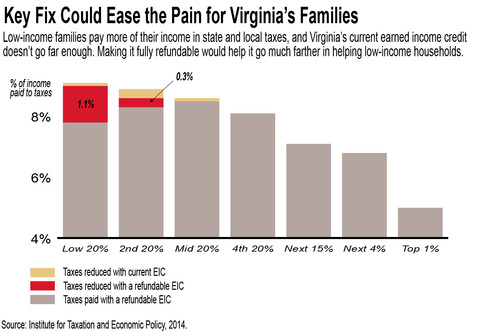

On the face of it, Virginia has a generous Earned Income Credit. But it ranks among the least effective EICs in the country because it isn’t refundable, according to a new report by the non-partisan Institute for Taxation and Economic Policy (ITEP).

The EIC gives Virginians working in low-wage jobs a modest income tax credit to help them afford necessities like child care and transportation. It supplements the federal Earned Income Tax Credit (EITC). But while the federal credit is refundable – meaning that if it exceeds the amount of income taxes owed, the taxpayer can get the difference as a refund – Virginia’s is not. Of the 26 states that have an Earned Income Credit, Virginia is one of only four that is not refundable.

Making Virginia’s credit refundable would allow low-income working families to keep more of what they earn by reducing the other taxes that they pay in addition to the income tax – including gas and sales taxes – and make the state’s tax system more fair.

In Virginia, people who earn less than $20,000 a year, the bottom fifth of households, pay an average of 9 percent of their income just in state and local taxes, according to ITEP’s latest figures. For families living on a full time minimum wage income of $14,500, for example, it means a state and local tax bill of $1,300—no small thing when they spend every penny just to make ends meet. By contrast, the top 1 percent of earners, who make more than $479,000, pay just 5 percent of their income toward these taxes.

Last year’s transportation package contributed to this problem, hitting low-income households especially hard.

For the poorest 20 percent of households, a refundable credit would reduce their state and local tax bill by 1.1 percentage points. For a family of three with a single earner working full-time at the minimum wage, that’s a reduction of $230. (You can see how the benefit works with this easy-to-use calculator.)

A refundable EIC wouldn’t completely correct the disparity between low-income and wealthier households, but it would be a strong start that helps low wages stretch a little further.

—Mitchell Cole, Research Assistant