Earned Income Credit Improvement Brings Broad Economic Benefits

Low-wage workers in Virginia have endured more than a decade of stagnant and declining wages, while also contending with the rising cost of food, housing, child care, and other household expenses, making it increasingly difficult for them to get by. Virginia lawmakers have a critical opportunity to help these working men and women meet their challenges by strengthening a key state income tax credit, at no direct expense to their employers.

Low-wage workers in Virginia have endured more than a decade of stagnant and declining wages, while also contending with the rising cost of food, housing, child care, and other household expenses, making it increasingly difficult for them to get by. Virginia lawmakers have a critical opportunity to help these working men and women meet their challenges by strengthening a key state income tax credit, at no direct expense to their employers.

A stronger Earned Income Credit (EIC) would give working families more resources to ensure they can get to their jobs, keep the lights and heat on, and put food on the table.

Virginia’s EIC gives a modest boost to the work effort and earnings of working families across the commonwealth. One simple improvement to the credit would help it to do so much more, strengthening its benefits not only for Virginia’s families, but also for the state’s businesses and economy.

The Virginia EIC is based on the federal earned income tax credit (EITC), for which over half a million Virginians were eligible in 2011. The federal tax credit is the country’s most successful anti-poverty tool for children, lifting over 3 million out of poverty each year. It’s also good for businesses at tax time and the economy in the short and long run.

But the federal credit has one important feature that makes it so effective and that distinguishes it from Virginia’s EIC: those who qualify for it can get a refund if the amount of their credit is greater than the income tax they owe, otherwise known as refundability.

Key findings of the report include:

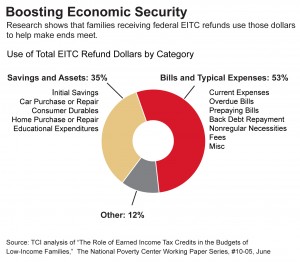

- More than half of the refunds that come from the federal credit go toward paying bills and other basic necessities like electricity and phone service. And more than a third is socked away as initial savings, according to the report.

- The refundable federal credit along with the Child Tax credit – another credit helping low-income families offset the cost of raising kids – helps lift 165,000 Virginians out of poverty each year, including 85,000 children.

- The federal and state credits can only be claimed by Virginians who work, and they are structured to encourage people to work more hours.

- Making the credit refundable would help lower the substantial state and local taxes paid by working families with low earnings, including the recently increased statewide sales tax.

- People who claim the refundable federal credit use their refunds mostly for basic expenses and things that make work possible including: car repair, education, overdue bills, and childcare.