On July 10, 2017, the Consumer Financial Protection Bureau (CFPB) announced a new rule to ban companies from using mandatory arbitration clauses to deny groups of people their day in court. We’re calling it the “No Rip Off Clause Rule” (Twitter: #RipoffClause).

On July 10, 2017, the Consumer Financial Protection Bureau (CFPB) announced a new rule to ban companies from using mandatory arbitration clauses to deny groups of people their day in court. We’re calling it the “No Rip Off Clause Rule” (Twitter: #RipoffClause).

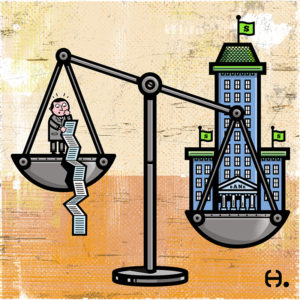

Many consumer financial products like credit cards and bank accounts have arbitration clauses in their contracts that prevent consumers from joining together to sue their bank or financial company for wrongdoing. By forcing consumers to give up or go it alone – usually over small amounts – companies can sidestep the court system, avoid big refunds, and continue harmful practices. The CFPB’s new rule will deter wrongdoing by restoring consumers’ right to join together to pursue justice and relief through group lawsuits.

“Arbitration clauses in contracts for products like bank accounts and credit cards make it nearly impossible for people to take companies to court when things go wrong,” said CFPB Director Richard Cordray. “These clauses allow companies to avoid accountability by blocking group lawsuits and forcing people to go it alone or give up. Our new rule will stop companies from sidestepping the courts and ensure that people who are harmed together can take action together.”

The rule’s effective date is 60 days following publication in the Federal Register and applies to contracts entered into more than 180 days after that.

More information about the CFPB’s arbitration rule is available at: https://www.consumerfinance.go

The text of the arbitration rule is available at: http://files.consumerfinance.g

A CFPB video explaining the arbitration rule is available at: https://youtu.be/boQ2tRW_AwE