While Washington, D.C. gridlocks over job creation, The New Bottom Line has answers: by writing down all underwater mortgages to market value, the nation’s banks could pump $2,014,240,650 into Virginia’s economy, create $29,771 jobs in Virginia, save Virginia families $576 per month on mortgage payments, and fix the housing crisis once and for all, according to a new report entitled “The Win/Win Solution: How Fixing the Housing Crisis Will Create One Million Jobs.” Nationwide, the plan would inject $71 billion per year into the economy, create more than one million jobs annually, save families $6,500 per year on mortgage payments, and end the housing crisis.

Grassroots organizations across the country aligned with The New Bottom Line campaign are calling onState Attorneys General who are investigating the banks for foreclosure fraud to stand firm for a settlement agreement that (1) includes large-scale principle reduction for underwater borrowers; and (2) does not to release the banks from claims beyond the robo-signing scandal. This would provide real restitution for homeowners and allow states to sue the banks for wrongdoing connected to the origination of mortgages and the steps leading up to foreclosure.

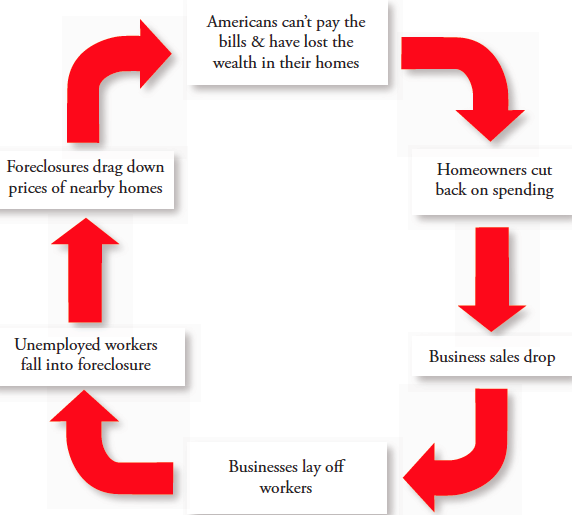

Homeowners across the nation are struggling to pay their boom-era mortgages with their recession-era salaries and the economy is suffering for it. Writing down the principals and interest rates on all underwater mortgages to market value would serve as the second stimulus that America so desperately needs, only without added costs to taxpayers.

Over 23 percent of Virginia’s homeowners owe more on their mortgage than their home is actually worth, with $291,394 of the Commonwealth’s mortgages under water. Collectively, Virginia’s underwater homeowners will have to pay down $17 billion in principal before they can start building equity in their homes. Every effort to reboot the housing market to date has failed because it has not done the most essential thing: reduce the massive debt load carried by underwater homeowners.

If the banks fix what they broke and wrote down principals on all underwater mortgages to current market value, it would inject a direct cash stimulus into the economy, redirecting billions of dollars that cash-strapped homeowners are currently paying on inflated mortgage debt toward other job-creating sectors of the economy. Nationally, the plan would lower homeowners’ mortgage payments by an average of more than $500 per month or $6,500 per year.

Six billion dollars per month that is currently going to mortgage payments would instead go toward buying groceries, school supplies, and other household necessities. As consumer demand picked up, businesses would start hiring again. The report estimates that putting $71 billion into American consumers’ pockets annually would help create more than one million jobs per year.

The report notes that the banks can afford to execute this plan. Last year, the nation’s top six banks paid out more than twice the cost of the plan ($71billion per year) in bonuses and compensation alone ($146 billion in 2010). Currently, the nation’s banks are sitting on a historically high level of cash reserves of $1.64 trillion.

###