On Saturday, February 25 at 11:00 am, Virginia Organizing supporters and community members will be meeting at the Bank of America at the Barracks Road shopping center to move their money and call on others to do the same.

The action is part of an ongoing divestment campaign Virginia Organizing kicked off at the Wells Fargo on the downtown mall on October 14, 2011. The “Move Our Money” divestment campaign is part of a nationwide effort from the New Bottom Line, a national coalition of organizations whose goal is to take $1 billion of our money out of the big banks—Bank of America, JP Morgan Chase, and Wells Fargo and put it into small banks and credit unions.

Saturday’s action comes after the Virginia General Assembly failed to pass any legislation this session to curb predatory lending in Virginia. One of the many reasons that Virginians are upset with the big banks is that they fund predatory lenders. Predatory lenders charge 300%APR and purposefully locate their shops in low-income minority communities and perpetuate a viscous cycle of debt for hard-working Virginians.

“Unfortunately, the Virginia General Assembly did nothing to curb predatory lending this session,” said Sandra Cook, Chairperson of Virginia Organizing. “Now we will turn to Bank of America and ask them to stop funding the predatory lenders that prey on our communities. Right now, big banks like Bank of America borrow money from the Federal Reserve at less than 1% interest, lend it out to predatory lenders at 3%, who turn around and lend it to our communities at 300% interest or more. We’re going to move our money until the big banks invest in our communities, instead of taking advantage of them.”

The Predators’ Creditors: How the Biggest Banks are Bankrolling the Payday Loan Industry

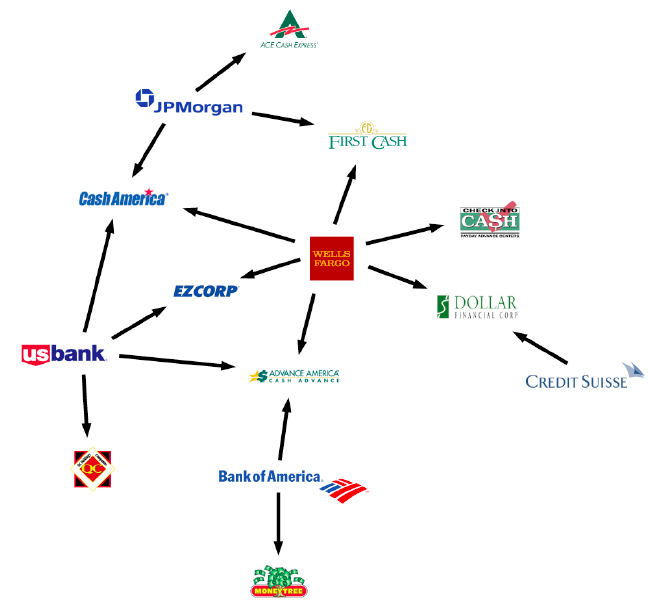

This follwoing report from National People's Action traces connections between the largest payday lenders and Wall Street banks, including financing arrangements, leadership ties, investments, and shared practices. The following are some of the report’s key findings:

Click below to download the full report:

Payday loan companies depend heavily on financing from big banks, including

Wells Fargo, Bank of America, and JPMorgan.

* Big banks provide $1.5 billion in credit to publicly held payday loan companies,

and an estimated $2.5-3 billion to the industry as a whole.

* Wells Fargo finances more payday lenders than any other big bank – six of the

eight largest payday lenders. Bank of America, JPMorgan Chase, and US Bank

also finance the operations of major payday lenders. Bank of America and Wells

Fargo provided critical early financing to the largest payday lender, Advance

America, fueling the growth of the industry.

* Publicly traded payday lenders paid nearly $70 million in interest expense on

debt in 2009 – a sign of how much banks are profiting by extending credit to

these companies.

* Some banks do not lend to payday lenders due to “reputational risks”

associated with the industry.

Many payday companies have strong ties to Wall Street.

* Two Bear Stearns executives guided the rise of payday lender Dollar Financial,

and two Goldman Sachs executives sat on the company’s board when it went

public.

* Advance America’s executives and board members have ties to Bank of

America, Morgan Stanley, and Credit Suisse.

* Bank of America and its subsidiaries own significant stakes (more than 1%) in

four of the top five publicly held payday lenders: Advance America, EZCORP,

Cash America, and Dollar Financial.

Payday financiers are major bailout recipients, and continued to extend credit to

payday lenders throughout the financial crisis and following the bailouts.

* Big banks financing major payday lenders received $105 billion in TARP funds in

late 2008. Bank of America received $45 billion, and Wells Fargo and JPMorgan

received $25 billion each. Big banks continued to negotiate and amend credit

agreements with payday lenders throughout the financial crisis and after the

bailouts.

* Two payday lenders, EZCorp and Cash America, used loans negotiated with JP

Morgan and Wells Fargo and shortly after the bailouts to buy pawn shop chains

in Las Vegas and Mexico.

Big bank financing of payday lending led to the rise of a powerful industry lobby

which has successfully fought efforts to cap interest rates.

* Several payday lenders began dominating the industry in the late nineties on the

strength of bank financing. These lenders formed a powerful lobbying group, the

Community Financial Services Association, which has spent $11.3 million on

federal lobbying efforts since its inception in 1999.

* Major payday lobbyists also lobby for financial institutions such as Morgan

Stanley, Fitch Ratings, Visa, Blackstone Group, the Managed Funds

Association, and the Private Equity Council. One lobbyist, Wright Andrews, was

previously a major lobbyist for the subprime mortgage industry.

* A national interest rate cap of 36% would effectively put payday lenders out of

business, according to Advance America’s disclosure filings, but such a cap

failed to gain traction during the financial reform process due to the clout of the

financial industry’s lobby.

There are signs that the payday lending business will expand in the future.

• Big banks such as Wells Fargo, US Bank, and Fifth Third are now offering new

payday loan-style products. Called “checking advance” products, these shortterm

loans carry interest rates of up to 120%.

• Some Wall Street analysts believe that the industry will grow in 2011 as

financially-stretched borrowers have increasing trouble securing credit cards.

The industry is also predicted to continue expanding into pawn lending and

other services, such as prepaid debit cards.

• Bank of America and Goldman Sachs are currently leading an IPO for prepaid

debit card company NetSpend, which partners with many payday lenders and is

owned by the owner of ACE Cash Express, JLL Partners.