Virginia Public Radio, April 13, 2015

Virginia Public Radio, April 13, 2015

RICHMOND,  Va. – Taxes are on the minds of many Virginians, and a new analysis examines where exactly federal income tax dollars are going.

Va. – Taxes are on the minds of many Virginians, and a new analysis examines where exactly federal income tax dollars are going.

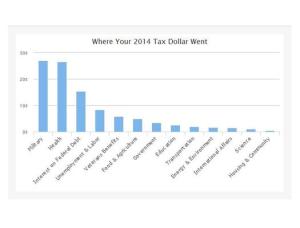

The National Priorities Project crunched the numbers, and the group’s research director, Lindsay Koshgarian, says out of every federal income tax dollar paid in 2014, 27 cents went to the military, 26 cents went to health programs and 15 cents went to interest on the federal debt.

“What that means is that there’s not a ton of money left over for everything else,” she points out. “That’s well of more than half of every tax dollar goes to pay for those three things.

“So, when you get down to something like education spending – you’re spending two and a half cents of each dollar you pay on education.”

The National Priorities Project says eight cents was spent on unemployment and labor, and five cents on veterans’ benefits, which Koshgarian says left the remaining pennies for food, agriculture, transportation, housing and programs involving energy and the environment.

The group found the typical Virginian paid an average of about $7,500 in various federal taxes in 2013 – not that far from the national average.

Almost half of all federal revenue comes from individual income taxes. And Koshgarian says another piece her group examined is the government’s complex system of tax breaks. She says they’re worth a lot.

“The amount that the government spends on tax breaks in giving money back to folks who pay taxes is actually bigger than what we spend in the federal budget each year on all of these programs, like the military and education, combined,” she points out.

According to the analysis, 10 of the largest tax breaks in 2013 overwhelmingly benefited the top 1 percent of households.