We strive to work towards a long-term solution that restores balance to the state’s budget and tax structure.

We do not support further budget cuts to vital services like education, transportation and public safety, or taking funding from one vital service to support another to avoid taxing the wealthy. When we cut our state’s infrastructure and services to the bone, it keeps our economy from moving forward, which is bad for everyone.

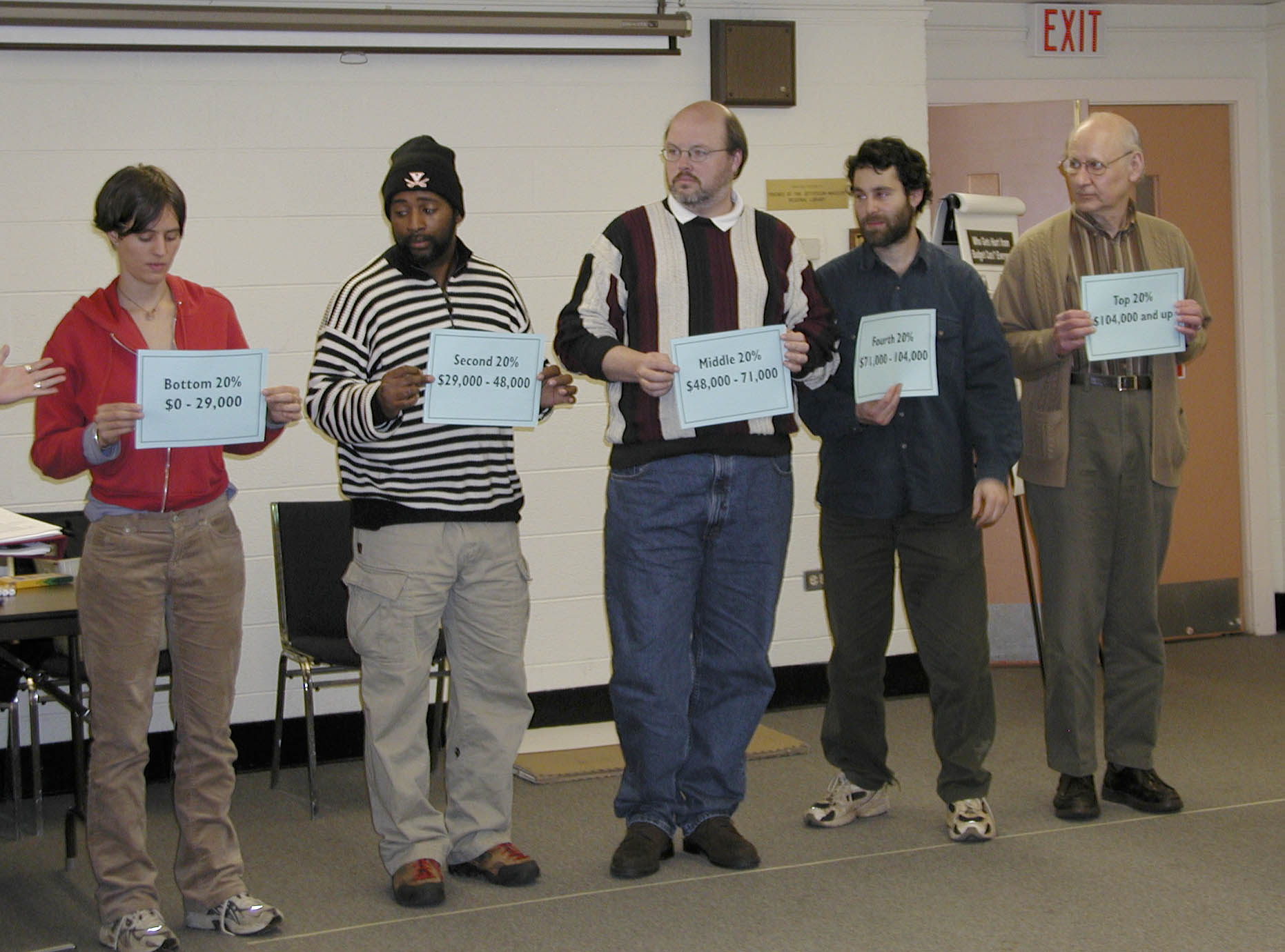

Additionally, we support progressive tax reform. Virginia’s tax structure is "old and rusty" and is in need of modernization. Low- and middle-income families in Virginia pay a higher share of their income in state and local taxes than do the richest families. Virginia’s low- and middle-income families are making tough sacrifices in this financial climate and should not be paying a higher percentage of income to taxes than the wealthiest Virginians, particularly when services that benefit families are being cut to provide tax breaks for large corporations and wealthy individuals.

Virginia has a regressive and unbalanced state tax structure that relies too much on sales taxes that disproportionately impact low- and middle-income families as well as an almost flat income tax in which not all taxpayers pay their fair share. This tax structure needs to be changed.